Annual Credit Report Can t Open Again

Federal law gives you lot free admission to your credit reports from the iii major credit bureaus: Equifax, Experian and TransUnion. Using the government-mandated AnnualCreditReport.com website is the quickest way to become them, just y'all can also asking them past phone or postal service. Until the end of the twelvemonth, those reports — which had been limited to once a yr — are available weekly to help consumers manage their finances.

Your credit reports are a detailed record of your by use of credit — but they practice not include your credit score. NerdWallet offers a gratis credit score and report , updated weekly using TransUnion data. Checking your score does not damage your credit.

Hither'south how to use AnnualCreditReport.com.

1. Get to the correct site

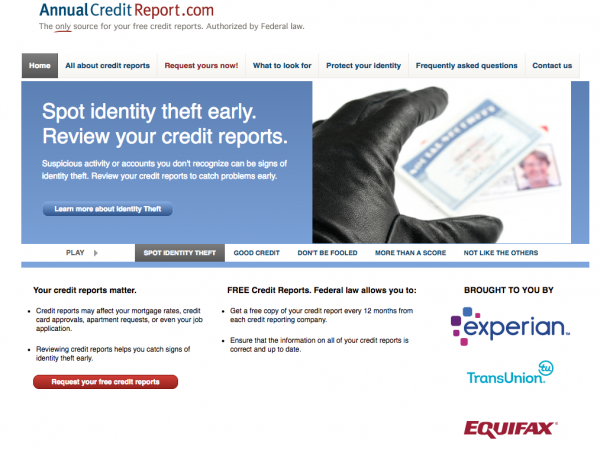

Offset, make sure you're on the right site: AnnualCreditReport.com . Some other sites have like-sounding names.

The one yous want looks like this:

2. Enter your personal information

You'll demand your name, Social Security number, accost and birthdate. This, forth with other personal data, will exist matched confronting files for identification.

three. Request a credit report or reports

You can lodge your reports from one, two or all three of the major credit bureaus : Equifax, Experian and TransUnion.

4. Successfully answer security questions

For each report request, you'll be asked a few questions about your finances that presumably just you lot can reply — for instance, the gauge amount of your mortgage payment or who holds your auto loan and when you took information technology out.

Some consumers have reported difficulty using the site, particularly answering security questions well-nigh accounts that are several years onetime. If you can't call back those details, yous can asking your reports by mail or phone; this procedure doesn't require security questions.

v. Generate your credit report online

Yous can relieve reports to your desktop or print them out so y'all'll have access subsequently.

If y'all demand to request a written report or reports by postal service, send a request grade to:

Annual Credit Study Request Service P.O. Box 105281 Atlanta, GA 30348-5281

Your report or reports should exist sent inside fifteen business days.

You tin can besides go your credit reports past calling 877-322-8228. Visually impaired consumers tin also telephone call this number to request sound, large-print or Braille reports.

6. Read your reports and fix errors

-

Accounts that aren't yours or you didn't qualify.

-

Incorrect, negative information.

-

Negative information that's as well old to be included. Nigh negative data, other than 1 type of bankruptcy, should be excluded after seven years.

These errors accept the potential to hurt your credit score, says Chi Chi Wu, a staff attorney with the National Consumer Police force Center. You might encounter other types of errors, such equally out-of-date employment information, she says, but those aren't factored into your score.

If yous find errors, dispute them. The credit bureaus will investigate and must remove information that they can't verify.

7. Monitor your credit regularly

Monitoring your scores and reports can tip you off to bug such as an overlooked payment or identity theft. Information technology also lets yous track progress on building your credit. NerdWallet offers both a free credit study summary and a free credit score, updated weekly.

Here's how the data you'll get from AnnualCreditReport.com differs from what costless personal finance sites may provide:

AnnualCreditReport.com provides:

-

Reports (non scores)

-

Information from all iii major credit bureaus

-

An extensive history of your credit apply

Personal finance websites, including NerdWallet, provide:

-

Credit scores, sometimes credit study information

-

Unlimited admission

-

Data from one or ii credit bureaus

-

A contempo history of your credit employ

-

Additional data about building and protecting your credit

Often asked questions

Is AnnualCreditReport.com safe?

AnnualCreditReport.com is authorized by federal law and condom to use — every bit long every bit you lot ensure you're on the right site.

Double-bank check the URL when you type it, to be sure y'all take non made a typo. Some other sites take similar-sounding names, then check that the URL matches and the site looks as expected.

Be aware that your credit reports are free, merely credit bureaus too use the AnnualCreditReport.com site to sell credit scores and promote paid services, such equally credit monitoring . Nevertheless, monitoring doesn't keep your identity from existence stolen; information technology just alerts you later on the fact. For best protection, use a credit freeze.

"Merely get your free credit report. Don't get suckered past the upsell," says Ed Mierzwinski, consumer program director for the U.S. Public Interest Research Group.

What do I get when I request reports?

Your creditors regularly written report your business relationship data, including payments, credit applications, the percent of bachelor credit you're using and negative marks such as collections. The three bureaus build that information into the credit reports that you get from AnnualCreditReport.com.

A credit report is not the same thing as a credit score . Your credit score is derived from some of the information in your credit reports.

If y'all used the online portal to access your reports, nosotros suggest saving them every bit PDFs or printing them out. One time you have them, read over them for mistakes.

When should I get my reports from AnnualCreditReport.com?

Get all three credit reports from AnnualCreditReport.com if yous've never done and so or information technology'south been at least a twelvemonth since the last fourth dimension.

Information technology's too wise to check them if yous've received payment modifications or other relief, such as offered during the pandemic, and demand to see whether creditors are reporting those accounts correctly.

And if you're about to apply for a large loan, such as a mortgage, you should become and check your credit reports. That gives you a chance to fix score-lowering issues before applying, giving yous a better shot at approval.

Is AnnualCreditReport.com rubber?

AnnualCreditReport.com

is authorized past federal law and safe to utilize — as long every bit you lot ensure you're on the correct site.

Double-check the URL when you type information technology, to be sure you accept not fabricated a typo. Some other sites have like-sounding names, so check that the URL matches and the site looks as expected.

Be aware that your credit reports are gratuitous, but credit bureaus as well use the AnnualCreditReport.com site to sell credit scores and promote paid services, such equally

credit monitoring

. Still, monitoring doesn't keep your identity from being stolen; it simply alerts y'all after the fact. For best protection, utilize a

credit freeze.

"Just get your costless credit report. Don't get suckered by the upsell," says Ed Mierzwinski, consumer plan director for the U.S. Public Interest Research Group.

What do I go when I asking reports?

Your creditors regularly report your business relationship information, including payments, credit applications, the percentage of bachelor credit you're using and negative marks such equally collections. The three bureaus build that data into the credit reports that y'all get from AnnualCreditReport.com.

A credit study is not the same matter as a

credit score

. Your credit score is derived from some of the information in your credit reports.

If y'all used the online portal to admission your reports, nosotros suggest saving them as PDFs or printing them out. Once you take them,

read

over them for mistakes.

When should I become my reports from AnnualCreditReport.com?

Get all three credit reports from AnnualCreditReport.com if you've never washed so or it'southward been at least a year since the last time.

It's also wise to check them if you lot've received payment modifications or other relief, such equally offered during the pandemic, and need to run across whether creditors are reporting those accounts correctly.

And if yous're most to apply for a large loan, such as a mortgage, you should get and check your credit reports. That gives you lot a chance to fix score-lowering bug before applying, giving you a better shot at approval.

See your free credit report

Know what'due south happening with your gratis credit report and know when and why your score changes.

Source: https://www.nerdwallet.com/article/finance/how-to-use-annualcreditreport-com